How to use candlestick charts for market analysis in cryptocurrency

The cryptocurrency trade world is a complex and fast environment, and prices are fluctuating rapidly due to market mood, economic indicators and other factors. One effective way to analyze the market and make informed trade decisions is the use of candle charts. In this article, we will explore how to use a candlestick for the analysis of the cryptocurrency market.

What are candlestick charts?

Candlestick diagrams are the type of technical analysis tool used in various financial markets, including stocks, future contracts and cryptocurrencies. The diagram shows an active closing price over time with additional lines and symbols that represent different types of data. Each candle denotes one trading day or a bar period.

Candlestick chart main components

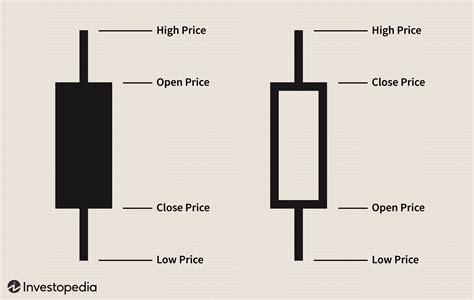

The standard candlestick chart consists of four main ingredients:

1

Body : The middle part of the candle, which is the highest high price (green) and the lower lowest price (red).

- Shadow : A smaller body under the main body, reflecting the difference between the closure price and the starting price.

3

Wick : A long and thin line stretching from the top and bottom of the chart, denoting opening and closing prices.

- Pip : The distance between two consecutive candle bodies.

How to use candlestick charts for cryptocurrency trade

When analyzing the cryptocurrency market using a candlestick, here are some of the main things to keep in mind:

- Identify trends

: Look for permanent price movements such as up or down trends that may indicate a strong purchase or sale signal.

- Analyze sown : Candles with increased volume usually reflect more buying activities while reducing volume signals, selling pressure.

3

Watch support and resistance : Identify the support levels (nearby) and resistance (long -term) where the price can retreat or break.

- Look for models : Meet common chart models such as triangles, wedges and heads and shoulders that can help determine possible trade options.

Types of candlestick charts

There are several types of candlestick charts you can use to analyze the cryptocurrency market:

- Candlesticks : Focus on price movement over time.

- Average reverse candlesticks : Identify pricing coups that can be used as a trade basis.

3

Breakout candlesticks : Watch candles that break through previous resistance levels or exceed previous heights.

Popular cryptocurrency trade tools

To improve your candlestick chart analysis, consider using the following popular cryptocurrency trade tools:

1

Tradingview : Robuste platform offering advanced candlestick charts and technical indicators.

- COINIIGY : A comprehensive tool that provides detailed market data, chart -making options and automation features.

3

Cryptoslate : Professional level platform for analysis of cryptocurrency markets with real -time updates.

Conclusion

Candlestick charts are a powerful tool for traders in the cryptocurrency market, allowing you to quickly identify trends, patterns, as well as the level of support and resistance. By using candlestick charts and attracting popular trading tools, you can make conscious decisions and increase your chances of success in the rapidly developed world of cryptocurrency trade.

Tips and Tricks

- Always use a 1 minute or 5 minute chart to perceive short -term price movements.

- Combine candlestick charts with other technical analysis tools, such as RSI (relative force index) and Bollinger bands for a more comprehensive market analysis.

- Be aware of market news and events that can affect cryptocurrency prices.