Market study techniques for hyperquidal assessment (HYPE)

The world of cryptocurrencies has undergone a significant increase in recent years, with us and innovative tokens in progress daily. Among them, hyperliquid (Hype) is distinguished as a promising project that aims to revolutionize how we think of decentralized finance (Defi). As such, the assessment of the potential of the media market is crucial for investors and amateurs. In this article, we will explore the market study techniques to evaluate the viability of the mass -the media thrown.

Market study goals

Before we sink into the analysis, it is essential to define our goals:

- Understand the concept of the project : Determine the main idea behind the media thrown and how it differs from other defy projects.

- Identify the main interested parties : Locate the persons and organizations involved in the trembling of the media, including their development team, community members and potential investors.

- Analyze the market trends : Examine the performance of the past market of similar cryptocurrencies to understand the current state of the waking media ecosystem.

- Evaluates the regulatory landscape : Evaluates the regulatory environment in force for Defi projects, as this can have an impact on the future media tremor.

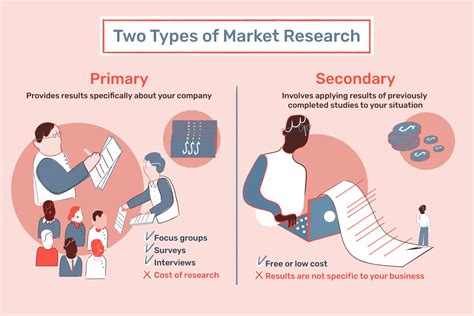

market study techniques

To perform an over -the -way -media analysis, we will use the following techniques:

- Social networks surveillance : Follow the conversations on Twitter and Reddit’s discussions on waking up the media to evaluate the interest and feeling between the target audience.

- Online forums : Visit online forums such as Telegram, Discord or Subredit to collect ideas with users discussing the potential and Hype challenges.

- News analysis : Search the famous media that will cover Defi projects, including their media coverage and market trends.

- Revue du Paper Blanc

: Examine the White Book to understand the technical architecture, tokenomic and the roadmap.

- The value of the chips : Analyze the measures such as the price of the chips, the volume of negotiation and the number of transactions for liquidity evaluation and the adoption of the media.

Competitive analysis

To determine if the board is a viable investment opportunity, we will compare it with other Defi projects:

- Capitalization comparison : Compare the market capitalization of the media with its colleagues, as it is compound or AAVE.

- Isbution performance : Analyze the price of chips and fluctuations of trading volume to identify potential trends and risks.

- Competitive landscape : Review existing Defi platforms that offer similar services with media, including loans, loans and yield.

Regulatory Environment

Understanding the regulatory landscape is crucial to investors:

- Regulation on decentralized finances (Defi) : Regulatory research updates on Defi projects, such as those issued by Securities and Exchange Commission in the United States (SEC).

- Digital centralities emitted by banks (CBDC) : The study how to tremble media technology can be affected by CBDC or their possible impact on the larger cryptocurrency market.

Conclusion

The evaluation of the Mass -Media drain using these market research techniques can help investors and amateurs make the knowledge of the potential investments in this new interesting project. Understanding its concept, the main stakeholders, its market trends, its regulatory landscape and its competitive position, we can identify the opportunities to capitalize on the potential of Mass -Beatteur, while reducing the risks. While the Ecosystem Defi continues to evolve, it is essential to remain aware of the market developments and to adjust our analysis accordingly.

Recommendations

Based on this analysis:

- Media wake up investors : Consider the allocation of part of your media portfolio, taking into account its competitive advantages and market potential.

- Research fans : Continue to monitor the media wake up ecosystem and be informed about the regulatory updates and market trends.

3 and 3